-

Inspiring Ideas for Notebooks: Boost Your Creativity and Organization

50 Best Ideas for Notebooks: Creative & Practical Ways to Fill Yours

Looking for innovative ways to fill your bla...

-

9 Flexible Ways to Make Money at Home Without Stress

Working from home is more than just a trend; it's a lifestyle choice for many folks today. Whether you're aiming to s...

-

15 Easy Ways to Make Money from Home Right Now

Ever thought about making some extra cash without even leaving your house? Well, you're in luck! There are tons of wa...

-

10 Proven Affiliate Marketing Strategies to Boost Your Earnings

Affiliate marketing can be a great way to earn some extra cash or even build a full-time income but it it's not just ...

-

A Step-by-Step Guide to Making Money Online from Home

Ever thought about making some extra cash without leaving your house? You're not alone. With the internet, there's a ...

-

Creative Empty Notebook Ideas: 15 Inspiring Ways to Fill Your Pages

Top 25 Creative Empty Notebook Ideas You’ll Love

Are you staring at an empty notebook, unsure of how to fill it? You’...

-

Easy side hustles for nurses to earn more

Nurses have a unique skill set that can open doors to a variety of side gigs. With flexible schedules, many find they...

-

Phone Side Hustles: 12 Apps That Turn Your Smartphone into a Money-Maker

In today's world, your smartphone can be much more than just a communication device; it can be a powerful tool for ma...

-

Blogging Using AI: The do's and don'ts

So, you're thinking about diving into the world of blogging using AI? It's a pretty exciting time, with technology ch...

-

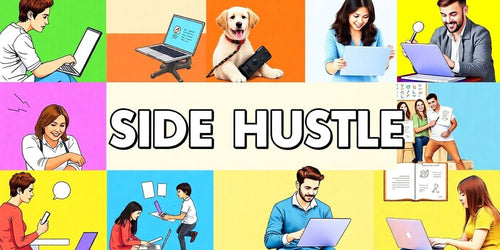

The 13 Best Side Hustles with no Experience in 2025

The 13 Best Side Jobs From Home No Experience in 2025

Thinking about diving into the world of side hustles but wor...

-

How to Pick a Side Hustle in 2025: Top Tips and Ideas for Extra Income

Looking to boost your income but not sure which side hustle to choose? This guide on how to pick a side hustle will h...

-

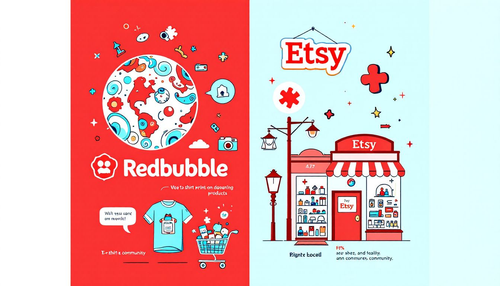

Redbubble vs Etsy: Best Platform for Artists in 2025

Redbubble vs Etsy: which is better for artists in 2025? This guide compares their different models, user experiences ...

-

The best 9 side hustles for nurses for 2025

Nurses have a unique skill set that can be used in many different ways. With the rise of technology and new healthcar...

-

Top 7 Side Hustle Courses to Jumpstart Your Extra Income in 2025

In today's world, many people are looking for ways to earn extra money beyond their regular jobs. Side hustle courses...

-

8 Flexible Side Hustles to Do from Your Phone Anytime, Anywhere

In today’s fast-paced world, making money through side hustles can be both exciting and rewarding. With the rise of ...

-

Easy Side Hustles for Nurses: 11 Flexible Options to Boost Your Income

Nurses have a valuable skill set that can be used in various side hustles to earn extra income. These side hustles ca...

-

Freelance Writing Side Hustle: How to Start and Succeed in 2025

Freelance writing is a fantastic way to earn money while enjoying flexibility and independence. If you're considering...

-

Online Marketing Side Hustle: 10 Strategies to Monetize Your Digital Skills

If you have digital skills and want to earn some extra cash, there are many online marketing side hustles you can exp...

-

Boost Your Book Sales with Amazon KDP Ads: A Practical Guide

Need to boost your Amazon book sales? Amazon KDP Ads can expand your reach. This guide shows you how to set up, manag...

-

Shopify Make Money Guide: Building a Profitable E-commerce Side Hustle

Starting an e-commerce business can be an exciting journey, especially with platforms like Shopify. I have ran high ...

-

Side Hustle Jobs for Teachers: A Comprehensive Guide to Boosting Your Income and Expanding Your Horizons

Side Hustle Jobs for Teachers: A Comprehensive Guide to Boosting Your Income and Expanding Your Horizons

The teaching...

-

Side Gigs for Nurses: A Comprehensive Guide to Boosting Your Income and Enhancing Your Skills

Side Gigs for Nurses: A Comprehensive Guide to Boosting Your Income and Enhancing Your Skills

As a nurse, you dedicat...

-

Remote Closing: The Ultimate Side Hustle for Aspiring Sales Pros

Remote closing is an exciting opportunity for those looking to earn extra income while enjoying the freedom of workin...

-

7 Side Hustles from Your Phone That Pay Real Money

If you're looking to make some extra cash without needing a car or a computer, you're in luck! There are plenty of si...

-

Amazon FBA Side Hustle: A Step-by-Step Guide to Success

Starting an Amazon FBA side hustle can be a great way to earn extra income or even create a full-time business. Pers...

-

Side Hustle Review: 25 Best Options Analyzed for 2025

If you're eager to boost your income, starting a side hustle might be just what you need. A side hustle lets you earn...

-

8 Profitable Side Hustles from Phone: Earn on the Go

In today's fast-paced world, making extra money on the go is easier than ever. With just a smartphone, you can dive i...

-

Empowering Moms: Top Side Hustles from Home for Moms in 2025

In 2025f, many moms are looking for ways to earn extra money while managing their family responsibilities. Side hustl...

-

The Ultimate Guide to Building a Successful Blog in 2025

Building a Successful Blog in 2025: A Comprehensive Guide

Starting and running a successful blog in 2025 requires mor...

-

10 Easy Side Hustles Online You Can Start Today

Are you eager to earn some extra cash without needing to spend money upfront? You’re not alone! Many people are on ...

-

13 Quick Online Side Hustles to Boost Your Income in 2025

In today’s world, many people are looking for quick and easy ways to earn extra income, whether you’re saving for som...

-

Unlocking Your Potential: How to Build a Successful Tutoring Side Hustle in 2025

Starting a tutoring side hustle in 2025 can be an exciting and rewarding venture. With the right approach, you can tu...

-

Unlocking Success: How to Make Money Online Side Hustle in 2025

In 2025, starting a side hustle can be a great way to earn money online and explore your passions. With the right app...

-

Unlocking Profit: The Ultimate Guide to an Amazon Seller Side Hustle

Are you ready to dive into the world of selling on Amazon? This guide is designed to help you understand the essentia...

-

Exploring Unique Virtual Side Hustles

In 2024, many people are looking for ways to earn extra money; virtual side hustles are a great option because they...

-

Exploring Leisurely Side Hustle Opportunities for Retirees: Unlocking New Opportunities

Retirement opens up a world of possibilities allowing individuals to explore new interests and earn extra income, esp...

-

Innovative Online Hustles to Make Money in 2025

In 2025, many people are looking for ways to earn extra money and online hustles provide a fantastic opportunity. Th...

-

Unlocking Potential: Top Side Hustles on Phone for 2025

In today's fast-paced world, smartphones are more than just communication tools; they can also be a source of extra i...

-

Unlock Your Potential: 10 Unique Side Hustles Online to Make Money this year

Are you looking to earn some extra cash in 2024 / 2025? With so many options available online, side hustles can be a ...

-

10 Side Hustles You Can Do From Your Phone to Boost Your Income

In today’s world, making extra money has become more accessible than ever. With just your smartphone, you can explore...

-

100 Best Side Hustles for Nurses in 2025: Unlock Your Potential and Earn Extra Cash!

100 Best Side Hustle Opportunities for Nurse Practitioners

Hey there, fellow nurses! Are you feeling like you’re stu...

-

Best Side Hustles for Seniors

Retirement can be a wonderful time to relax, but many seniors find themselves looking for ways to stay active and ear...

-

How Writing as a Side Hustle Can Boost Your Income

Freelance writing is a great way to earn extra money while doing something you love. It offers flexibility, allows yo...

-

101 Side Hustle Ideas to Boost Your Income

Engaging in side hustles has become increasingly popular as people look for ways to supplement their income. By util...

-

Side Hustle Jobs for 13 Year Olds: The Ultimate Guide to Earning Extra Cash and Building Skills

Side Hustle Jobs for 13 Year Olds: The Ultimate Guide to Earning Extra Cash and Building Skills

Remember those days o...

-

10 Profitable Side Hustles to Do From Your Phone

In today’s world, your smartphone can do more than just help you connect with friends. It can actually help you earn ...

-

Exploring Side Hustles for Retirees: Unlocking New Income Opportunities

Retirement can be a wonderful time to relax and enjoy life, however many retirees find that their fixed income isn’t ...

-

Unlocking Potential: Top AI Side Hustles to Boost Your Income

Artificial Intelligence (AI) is changing the way we work, live, and make money. If you're interested in technology an...

-

Unlocking Your Potential: A Guide to Side Hustle Writing

Unlocking your potential through side hustle writing is an exciting journey that combines creativity with the oppor...

-

Crafting the Perfect Blogging Logo: A Comprehensive Guide

The Power of a Blogging Logo: More Than Just a Pretty Picture

In the vast landscape of the internet, where countless ...

-

Crypto Trading - a Beginners Guide

Crypto trading can seem like a big, confusing world, but it doesn't have to be. This beginner's guide will break down...

-

How to Start Investing in Crypto: A Comprehensive Guide for Beginners

Introduction: Embarking on Your Crypto Investment Journey

The world of crypto investing has experienced a meteoric ri...

-

How to Start Investing in a REIT: A Step-by-Step Guide

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing ...

-

Dropship vs Inventory: A comparison between Dropshipping and all other eCommerce models

In the world of online shopping, two popular business models stand out: dropshipping and inventory management. Each h...

-

KDP Self Publishing: From Manuscript to Bestseller in 2025

In 2024, self-publishing on Amazon through Kindle Direct Publishing (KDP) is more accessible than ever and this is se...

-

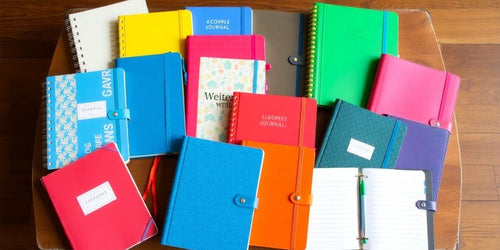

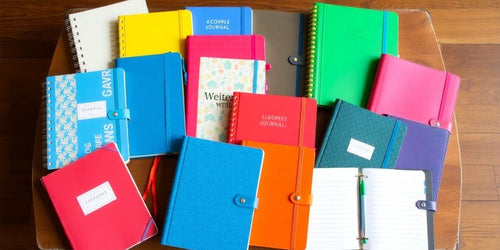

KDP Journals: How to Create and Market Effectively

Thinking about diving into the world of Kindle Direct Publishing? It's a pretty good way to share your creativity and...

-

Amazon KDP Pricing Calculator: Maximizing Profits for Self-Publishers

If you’re a self-publisher on Amazon, knowing how to price your eBooks effectively can be the key to your success. T...

-

Best Selling Journals on Amazon KDP and What They Teach

Ever wonder why some journals fly off the shelves on Amazon KDP? It's not just about having a pretty cover or a catch...

-

Etsy vs redbubble: Which platform suits you best

Redbubble vs Etsy: Which One Is Right for You?

Thinking of selling online but not sure where to start? Etsy and R...

-

AliExpress Dropship Store: 7 tips to start your eCommerce Journey

Starting an AliExpress dropship store can be a game-changer if you're looking to dive into eCommerce without the hass...

-

Shiny Words KDP Calculator: Your Go-To KDP Calculator Guide!

Ever tried to juggle all the numbers and details when publishing a book on Amazon? It can be a real headache, right? ...

-

Aliexpress USA Suppliers & Dropshipping From The USA

Looking to boost your dropshipping game by using AliExpress USA suppliers? You're in the right spot. Many dropshipper...

-

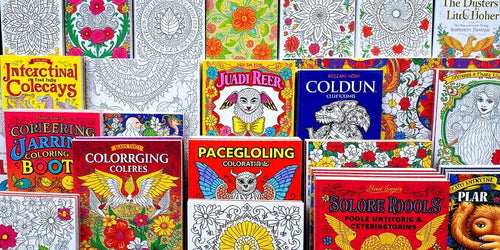

Sell coloring books on amazon step by step

So, you're thinking about selling coloring books on Amazon, huh? Well, you're in the right place! This guide will wal...

-

Drop Shipping Custom Packaging for Your Products

So, you're thinking about dropshipping and want to stand out? Custom packaging might just be your ticket. It's more t...

-

Mastering How to Sell Art Prints on Amazon: A Practical Guide

Best Practices to Sell Art Prints on Amazon: A Step-by-Step Guide

Looking to sell art prints on Amazon? This guide co...

-

How to Create a Coloring Book to Sell on Amazon

Ever thought about turning your doodles into dollars? Creating a coloring book to sell on Amazon might be your ticket...

-

Difference between dropshipping and amazon FBA

Alright, so you're thinking about jumping into the world of e-commerce, and you've probably heard about dropshipping ...

-

How Much Does It Cost to Publish a Coloring Book? A Complete Guide

How Much Does It Cost to Publish a Coloring Book? Find Out Here!

Publishing a coloring book, including an adult color...

-

Selling Journals on Amazon Made Easy

Thinking about selling journals on Amazon? It might seem like a big task, but with the right steps, you can make it h...

-

Best Products to Dropship on Amazon in 2025

Are you considering starting an Amazon dropshipping business? You're in the right place! Dropshipping is an exciting ...

-

The Ultimate Guide to Shopify Dropshipping AliExpress in 2025

Top Guide: Shopify Dropshipping AliExpress Simplified for 2025

Shopify dropshipping AliExpress is a straightforward e...

-

The Ultimate Guide to Dropshipping AliExpress: Start Profiting Today

Top Tips for Successful Dropshipping AliExpress Business in 2025

Ready to start dropshipping Aliexpress? This article...

-

Can you make money selling journals on amazon

Ever thought about turning your creativity into cash? Selling journals on Amazon might just be the gig for you. With ...

-

Dropshipping Side Hustle: a Look at Dropshipping in 2025

Thinking about starting a dropshipping side hustle in 2025? It's a business model that's been around for a while, and...

-

Amazon KDP Royalty Calculator: Understanding Your Earnings Potential

Understanding how to calculate your earnings as an author on Amazon can be tricky. The Amazon KDP Royalty Calculator ...

-

Aliexpress Dropshipping Center: The definitive Guide for 2025

Hey there, thinking about diving into dropshipping in 2025? Well, the AliExpress Dropshipping Center might just be yo...

-

How much do Dropshippers make? A look at dropshipping profits in 2025

So, you’ve probably heard about dropshipping, right? It’s that business model where you sell stuff without actually h...

-

Dropship vs Wholesale: What to chose in 2025?

So, you’re thinking about diving into the world of online selling in 2025 and can’t decide between dropshipping or wh...

-

The Best Print on Demand for Etsy: Tips to Boost Your Sales

10 Best Print on Demand for Etsy: Maximize Your Sales and Creativity

Want to grow your Etsy store without managing st...

-

Maximize Your Earnings: A Guide to Print on Demand Passive Income

Top Strategies for Earning Print on Demand Passive Income

Curious about earning passive income with Print on Demand p...

-

Top Strategies for Selling Coloring Books on Amazon: A Beginner’s Guide

How to Make a Coloring Book to Sell on Amazon: A Beginner's Guide

Are you wondering how to create a coloring book ...

-

9 Best Dropshipping Products to sell in 2025

Hey there, thinking about jumping into the dropshipping game for 2025? Well, you’re in luck because I’ve put together...

-

Choosing an e-commerce Niche for your Dropshipping Store - Step-by-Step Guide

So you’re thinking about starting a dropshipping store? Picking the right e-commerce niche is where it all begins. It...

-

Dropshipping vs. Traditional E-commerce: Which Model is Right for You?

Trying to decide between dropshipping and traditional e-commerce? It's a big choice and each has its own perks and pi...

-

5 Best Dropshipping Platforms for Beginners

Thinking of diving into the world of dropshipping? You’re not alone. It’s a popular way to run an online store withou...

-

Master Selling Prints on Amazon: A Quick Guide

How to sell Prints on Amazon - Quick Bullets

If you want to sell your art or designs on Amazon, here’s how to do it s...

-

Print on Demand for Etsy - How does it work in 2025?

How Does Etsy Print on Demand work?

A quick Step-by-Step Process:

1. Design & Listing

Create your designs using ...

-

Top 20 Ecommerce Blog Topics to Boost Your Online Store in 2025

Need ecommerce blog topics that can boost your online store’s success in 2025? This article lists 20 proven blog ide...

-

Dropshipping Profit Margin: A Comprehensive Breakdown

Average Dropshipping Profit Margin: A Comprehensive Breakdown

So, you're thinking about diving into the world of dr...

-

Top 10 Shopping Cart Abandonment Software Solutions to Boost Sales in 2025

Struggling with high shopping cart abandonment rates in your ecommerce store? Shopping cart abandonment software can ...

-

Best Tips to Sell Art Prints on Amazon Successfully in 2025

Ready to sell art prints on Amazon and sell art online? Start by setting up your Amazon Seller Account, selecting a...

-

Dropshipping Customer Service: How to Handle Customer Service in Your Dropshipping Business

Customer Service in Dropshipping: How to Handle It in Your Business

Running a dropshipping store can be a wild rid...

-

Dropshipping Shipping Strategies; Navigating Shipping and Fulfillment in Dropshipping in 2025

Dropshipping is like running an online store without the hassle of handling products yourself. You sell items, but yo...

-

e-commerce Legal Requirements: Legal Considerations for E-commerce Entrepreneurs

Jumping into the e-commerce world? It's not just about setting up a website and selling stuff. There are laws and rul...

-

Dropshipping Branding Strategies: Building a Brand with Dropshipping in 2025

In the competitive world of e-commerce, having a strong brand is essential for success, especially in dropshipping. T...

-

Dropshipping SEO Tips: The Role of SEO in Dropshipping Success, a Beginner's Guide

If you're looking to succeed in dropshipping, understanding the role of SEO is crucial. This beginner's guide will pr...

-

Dropshipping Analytics Guide: How to Improve Your Dropshipping Store's Performance in 2025

In the fast-paced world of e-commerce, understanding dropshipping analytics is crucial for success. This dropshipping...

-

Scaling Your Dropshipping Business in 2025: From Side Hustle to Full-Time Income

Scaling your dropshipping business from a small side project to a full-time income is an exciting journey. With the r...

-

Dropshipping Average Income: What New Sellers Can Expect in 2025

Dropshipping is a business model where you sell products without keeping them in stock. You take orders through your ...

-

Average Shopify Dropshipping Income: Realistic Expectations for 2025

Dropshipping through Shopify has become a popular way for many people to start their own ecommerce store and online b...

-

Are Dropshipping Courses Worth It? An Objective Analysis

In the world of online business, dropshipping has become a popular way for people to start their own stores without n...

-

AliExpress Dropshipping Reviews: Real Experiences from Entrepreneurs

In the world of e-commerce, AliExpress dropshipping has gained significant attention from entrepreneurs looking to st...

-

Mastering the AliExpress Dropshipping Center Dashboard

The AliExpress Dropshipping Center Dashboard is a powerful tool that can help you streamline your dropshipping busine...