P2P lending passive income: Explore the Risks and Rewards

Share

Peer-to-peer (P2P) lending has become a popular way for people to earn passive income by lending money directly to borrowers. This method skips traditional banks and connects lenders and borrowers through online platforms. While P2P lending can offer attractive returns, it also comes with specific risks. In this article, we will explore the essential aspects of P2P lending, including how it works, its potential rewards, the risks involved, and tips for successful investing.

Key Takeaways

- P2P lending connects lenders directly to borrowers, allowing for potentially higher returns than traditional savings.

- Investors can earn passive income through regular interest payments from borrowers.

- Diversification is crucial; spreading investments across multiple loans can reduce risk.

- Understanding the risks, such as borrower defaults and platform issues, is essential before investing.

- Choosing a reputable P2P platform is key to successful investing in this space.

Understanding P2P Lending Passive Income

What Is P2P Lending?

Peer-to-peer (P2P) lending is a way for individuals to lend money directly to other individuals without going through a bank. This method connects lenders and borrowers on online platforms allowing for a more personal and often more profitable lending experience. In essence, it cuts out the middleman enabling lenders to earn interest on their funds while helping borrowers access loans more easily.

How P2P Lending Works

In P2P lending, lenders deposit money into a platform, which then allows them to choose which borrowers to fund. As borrowers repay their loans, lenders receive monthly payments that include both principal and interest. The interest rates are typically set at the beginning of the loan and the process is similar to how a mortgage works. Here’s a simple breakdown of the process:

- Choose a platform: Find a reputable P2P lending site.

- Deposit funds: Add money to your account for lending.

- Select borrowers: Review borrower profiles and choose who to lend to.

- Receive payments: Get monthly repayments as borrowers pay back their loans.

Key Players in P2P Lending

The main participants in P2P lending include:

- Lenders: Individuals who provide funds to borrowers.

- Borrowers: Individuals seeking loans for various purposes.

- P2P Platforms: Online services that facilitate the lending process, manage transactions, and ensure that payments are made.

Investing in P2P lending can be a way to earn passive income while helping others achieve their financial goals, however it is important to understand the risks involved as well.

The Mechanics of Earning Passive Income Through P2P Lending

Regular Interest Income

P2P lending allows investors to earn regular interest income from the loans they provide. When borrowers make their payments, lenders receive interest which can be a steady source of cash flow. The total interest earned depends on several factors:

- Loan amount

- Interest rate

- Borrower’s repayment behavior

This means that having a diversified portfolio of loans can help stabilize income.

Automated Investment Options

Many P2P platforms offer automated investment features - this means that once you set your preferences the platform can automatically distribute your funds to new loans. This saves time and helps you invest without needing to manually select each loan. Here’s how it works:

- Set your investment criteria (like risk level and loan type).

- The platform automatically finds suitable loans for you.

- You receive interest payments without active management.

Reinvesting Repayments

As borrowers repay their loans, lenders can choose to reinvest those repayments into new loans. This strategy can help grow your total loan portfolio and increase your passive income over time. By continuously reinvesting, you can take advantage of compounding interest which can significantly boost your earnings.

Investing in P2P lending can be a great way to earn passive income, but it’s important to understand the risks involved.

In summary, P2P lending offers several ways to earn passive income, including regular interest payments, automated investment options and the ability to reinvest repayments. By understanding these mechanics, you can make informed decisions about your investments in this growing field.

Evaluating the Risks of P2P Lending

Default Risk

One of the biggest risks in P2P lending is default risk, this means that borrowers might not pay back their loans. Research shows that defaults can happen more often in P2P lending than in traditional banks, sometimes exceeding 10%. In comparison, banks have a much lower delinquency rate, usually around 1.44%.

Credit Risk

Another concern is credit risk. P2P lenders often lend to individuals and small businesses with different credit scores. Borrowers with lower credit scores are more likely to default which can lead to losses for lenders. It's important to check the creditworthiness of borrowers before investing.

Platform Risk

Lastly, there is platform risk. If a P2P platform faces financial issues or goes out of business, lenders may struggle to get their money back. Unlike bank deposits, P2P loans usually do not have government insurance, making it crucial to choose a reliable platform.

Summary of Risks

Here’s a quick summary of the risks:

- Default Risk: Borrowers may not repay loans.

- Credit Risk: Lending to borrowers with low credit scores increases risk.

- Platform Risk: Financial issues with the platform can lead to losses.

Understanding these risks is essential for anyone considering P2P lending. It helps you make informed decisions and manage your investments wisely.

Rewards of Investing in P2P Lending

Higher Returns Compared to Traditional Investments

Investing in P2P lending can lead to higher returns than traditional savings accounts or bonds. Many investors find that they can earn more by lending directly to borrowers. Here’s a quick comparison:

| Investment Type | Average Return Rate |

|---|---|

| P2P Lending | 7% - 12% |

| Savings Accounts | 0.5% - 2% |

| Bonds | 2% - 5% |

Diversification Benefits

P2P lending allows you to spread your money across various loans, which helps reduce risk. Here are some ways to diversify:

- Invest in different loan types (personal, business, etc.)

- Choose borrowers with varying credit scores

- Use multiple P2P platforms to minimize platform risk

Transparency and Control

Investors in P2P lending enjoy a level of transparency and control that is often missing in traditional investments. You can:

- Review borrower profiles and loan details

- Set your own investment criteria based on risk tolerance

- Monitor your investments regularly

P2P lending offers a unique opportunity to earn passive income while helping others access funds. It’s a win-win situation for both lenders and borrowers!

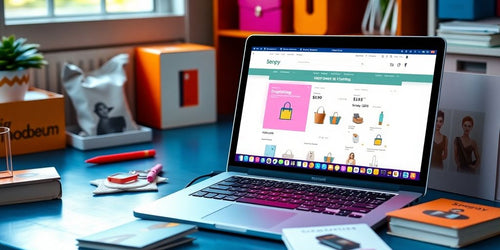

Choosing the Right P2P Lending Platform

When diving into P2P lending, selecting the right platform is crucial. Here are some key factors to consider:

Reputation and Track Record

- Look for platforms with a solid reputation.

- Check user reviews and ratings.

- Research their history of successful loan transactions.

Fee Structures

- Understand the fees associated with the platform.

- Compare different platforms to find the most cost-effective option.

- Be aware of any hidden charges that may apply.

User Experience and Tools

- Evaluate the platform's interface for ease of use.

- Check if they offer tools for tracking investments.

- Look for features like automated investing options.

Choosing the right P2P lending platform can significantly impact your investment success - make sure to do your homework before committing your funds - there are good rewards for P2P lending but as about to be described, the risks are higher.

In summary, when selecting a P2P lending platform consider its reputation, fee structures and user experience, this will help you make informed decisions and maximize your potential returns.

Strategies for Successful P2P Lending

Diversifying Your Loan Portfolio

To minimize risks in P2P lending diversification is key. Here are some strategies to consider:

- Spread your investments across various loans to reduce the impact of any single default.

- Invest in loans with different credit ratings to balance risk and reward.

- Use multiple P2P platforms to avoid putting all your money in one place.

Assessing Borrower Profiles

Before lending, it’s important to evaluate potential borrowers. Here’s how:

- Check credit history: Look for borrowers with a strong credit score.

- Review financial stability: Ensure they have a steady job and manageable debt levels.

- Understand loan purpose: Knowing why they need the loan can help assess risk.

Setting Investment Criteria

Establishing clear criteria can help you make better lending decisions:

- Decide on the minimum credit score you’re comfortable with.

- Set a limit on how much you’ll invest in any single loan.

- Determine the interest rate range that meets your investment goals.

By following these strategies, you can enhance your chances of success in P2P lending. Remember, careful planning and research are essential for maximizing your returns while minimizing risks.

Comparing P2P Lending to Other Investment Options

P2P Lending vs. Savings Accounts

- Higher Returns: You could earn higher returns from interest rates on a peer loan than from other types of investment, but there are risks.

- Liquidity: Savings accounts allow easy access to your money, while P2P loans are less liquid.

- Risk: Savings accounts are generally safer, often insured by the government, unlike P2P loans.

P2P Lending vs. Bonds

- Interest Rates: P2P lending can offer better interest rates compared to traditional bonds.

- Default Risk: Bonds are usually backed by governments or corporations, while P2P loans carry a higher risk of default.

- Investment Duration: Bonds can have longer terms, while P2P loans often have shorter durations.

P2P Lending vs. Stock Market

- Volatility: The stock market can be very volatile, while P2P lending offers more stable returns.

- Investment Control: P2P lending allows you to choose specific loans, giving you more control over your investments.

- Potential Returns: While stocks can yield high returns, they also come with higher risks compared to P2P lending.

In summary, while P2P lending can provide attractive returns it is essential to weigh the risks against other investment options. - diversifying your investments can help manage these risks effectively.

Legal and Regulatory Considerations

Understanding P2P Lending Regulations

P2P lending is a relatively new industry and understanding the regulations is crucial for both lenders and borrowers. In the U.S., the SEC began regulating P2P platforms in 2008, making it essential to check if a platform complies with relevant laws. Here are some key points to consider:

- Check for compliance: Ensure the platform follows state and federal regulations.

- Research the platform: Look into the platform's history and any warnings issued by regulatory bodies.

- Stay informed: Regulations can change, so keep up with any updates that may affect your investments.

Compliance Requirements

Investors should be aware of the compliance requirements that P2P platforms must meet. This includes:

- Licensing: Some states require P2P lenders to obtain a license to operate.

- Disclosure: Platforms must disclose their lending practices and available products.

- Consumer protection: Regulations often aim to protect consumers from unfair practices.

Protecting Your Investments

To safeguard your investments in P2P lending, consider the following strategies:

- Diversify your portfolio: Don’t put all your money into one platform or loan.

- Monitor your investments: Regularly check the performance of your loans.

- Choose reputable platforms: Invest only in platforms with a strong track record.

Understanding the legal landscape of P2P lending can help you make informed decisions and protect your investments. Research is key to navigating this evolving industry.

Managing Risks in P2P Lending

Monitoring Loan Performance

To effectively manage risks in P2P lending, it’s crucial to keep an eye on how your loans are performing. Here are some steps to consider:

- Track repayment schedules: Regularly check if borrowers are making their payments on time.

- Review borrower profiles: Look at the creditworthiness of borrowers to assess their likelihood of default.

- Stay updated on platform news: Be aware of any changes or issues with the P2P platform you are using.

Using Insurance and Guarantees

Investors can also protect themselves by considering the following options:

- Loan guarantees: Some platforms offer guarantees that can help recover funds in case of default.

- Insurance products: Look for platforms that provide insurance against borrower defaults.

- Diversification: Spread your investments across multiple loans to reduce the impact of any single default.

Adjusting Investment Strategies

As the market changes, it’s important to adapt your investment strategies. Here are some tips:

- Reassess your risk tolerance: Make sure your investments align with your comfort level regarding risk.

- Reinvest repayments: Use the money you earn from repayments to invest in new loans, keeping your portfolio active.

- Limit exposure: Keep P2P lending to a small portion of your overall investment portfolio to minimize risk.

Investing in P2P lending requires careful attention to risks. By actively managing your investments, you can better navigate the challenges and protect your capital.

The Future of P2P Lending

The future of P2P lending seems promising as it gains more popularity as an alternative to traditional banking. The market is valued at approximately 161.25 billion USD in 2023 and it is projected to expand at a compound annual growth rate (CAGR) of 27.6% through 2029. Here are some trends and developments that could shape the future of P2P lending.

Technological Innovations

- Improved Platforms: New technologies will enhance user experience and security.

- AI and Data Analytics: These tools will help assess borrower risk more accurately.

- Blockchain: This could increase transparency and reduce fraud.

Market Growth Projections

- Increased Participation: More investors and borrowers are expected to join the market.

- Global Expansion: P2P lending will likely spread to more countries.

- Diverse Offerings: Platforms may offer a wider range of loan types and investment options.

Potential Challenges Ahead

- Regulatory Changes: Governments may introduce new rules to protect consumers.

- Market Competition: As more players enter, competition will increase.

- Economic Factors: Changes in the economy could impact loan demand and default rates.

The P2P lending landscape is evolving, and staying informed about these trends is crucial for investors and borrowers alike.

Case Studies of Successful P2P Investors

Individual Investor Success Stories

Many individual investors have found success in P2P lending by following a few key strategies. Diversification is crucial; spreading investments across various loans can help mitigate risks - below are some common success factors:

- Choosing high-quality borrowers: Investors often focus on borrowers with strong credit ratings.

- Regularly monitoring investments: Keeping an eye on loan performance helps in making timely adjustments.

- Utilizing automated tools: Many platforms offer automated investment options that can simplify the process.

Institutional Investor Involvement

Institutional investors have also entered the P2P lending space, bringing significant capital and expertise. They often:

- Leverage data analytics to assess borrower risk more accurately.

- Negotiate better terms due to their larger investment amounts.

- Participate in multiple platforms to diversify their portfolios further.

Lessons Learned from Failures

Not every investment is a success. Some investors have faced challenges, leading to valuable lessons:

- Understand the platform's stability: Many investors learned the hard way that not all platforms are reliable.

- Be cautious with high-risk loans: Some investors lost money by investing in loans with poor credit ratings.

- Stay informed about market conditions: Economic downturns can significantly impact loan repayments, as seen during the COVID-19 pandemic.

P2P lending can be a rewarding investment but it requires careful planning and awareness of the risks involved. Investors should always be prepared for the unexpected.

In the world of peer-to-peer investing, many have found great success. These investors have shared their stories, showing how they made smart choices and grew their wealth. Want to learn more about how you can start your own journey? Visit our website for tips and resources that can help you succeed!

Final Thoughts on P2P Lending

P2P lending can be a smart way to earn extra money to supplement your income, it allows people to make money from interest payments while helping others get loans. However, it’s important to remember that there are risks involved, like the chance that borrowers might not pay back their loans. To do well in P2P lending, it’s essential to research different platforms, spread your money across various loans and keep an eye on your investments. By understanding both the good and bad sides of P2P lending, you can make informed choices and potentially enjoy a steady stream of passive income.

Frequently Asked Questions

What is peer-to-peer (P2P) lending?

P2P lending is a way for people to lend and borrow money directly without banks. It connects borrowers who need loans with lenders who want to earn interest on their cash.

How can I earn money with P2P lending?

You can earn money by lending to borrowers and receiving interest payments. The more loans you have, the more income you can make.

Is P2P lending safe?

P2P lending is riskier than keeping money in a bank, but it can offer higher interest rates. Make sure to research borrowers carefully.

What are the risks of P2P lending?

Risks include borrowers not paying back loans, the platform having issues, and changes in the economy that might affect repayments.

How do I choose a P2P lending platform?

Look for platforms with good reputations, clear fees, and user-friendly tools. Check reviews and see how they handle loans.

Can I automate my P2P lending investments?

Yes, many P2P platforms offer automated options that can help you invest your money without having to choose each loan manually.

What should I do if a borrower defaults?

If a borrower doesn't pay back their loan, you might lose some or all of your investment. Diversifying your loans can help reduce this risk.

What is the future of P2P lending?

P2P lending is expected to grow, with new technologies making it easier to connect lenders and borrowers. However, it will also face challenges like competition and regulations.